Return to flip book view

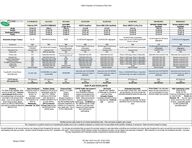

2024 Chamber of Commerce Plan GridSingle$1,063.29$880.15$841.64$747.88$713.97$761.44$602.34$663.62Double$2,126.58$1,760.30$1,683.28$1,495.76$1,427.94$1,522.88$1,204.68$1,327.24Employee/Child(ren)$1,807.59$1,496.26$1,430.79$1,271.40$1,213.75$1,294.45$1,023.98$1,128.15Family$3,030.38$2,508.43$2,398.67$2,131.46$2,034.81$2,170.10$1,716.67$1,891.32 Deductible (Single / Family)$0 / $0 $250/$500 (Embedded) $0/$0$2,200/$4,400 (Aggregate) $2,500/$5,000 (Aggregate)$6,000/$12,000 (Embedded) Copays apply for first $3,000 Single/$6,000 Family in services$6,350 Single/$12,700 Family (Aggregate)$7,050/$14,100 (Aggregate)CoinsuranceN/AN/AN/AN/AN/AN/A20%N/AOut of Pocket/Coinsurance Maximum$7,500/$15,000 Embedded$9,100/$18,200 Embedded$8,700 Single /$17,400 Family (Embedded)$7,050 Single/$14,100 Family (Embedded)$6,500 Single/$13,000 Family (Embedded)$6,000 Single/$12,000 Family (Embedded)$7,200 Single/$14,400 Family (Embedded)$7,050 Single/$14,100 Family (Aggregate)Preventive Care Covered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullBonus CardN/A$200 per subscriberN/AN/AN/AN/AN/AN/APrimary Care $15 Deductible then $30$0 Enhanced Primary Care Physician/$50 Non-EPCDeductible then $30Deductible then $25 Phase 1; $30 Copay Phase 2; Deductible Deductible then Covered In FullDeductible then Covered In FullSpecialist Visit$20 Deductible then $50$50Deductible then $40Deductible then $50Phase 1; $50 Copay Phase 2; Deductible Deductible then 20%Ded then Covered In FullInpatient Hospitalization$500 Deductible then $1,500$1,500Deductible then $1,500Deductible then $500Phase 1; $500 Copay Phase 2; Deductible Deductible then 20%Ded then Covered In FullOutpatient Surgery$50 Deductible then $150$200Deductible then $200Deductible then $200Phase 1; $50 Copay Phase 2; Deductible Deductible then 20%Ded then Covered In FullEmergency Room/Ambulance$100 Deductible then $200$500Deductible then $500Deductible then $300Phase 1; $75 Copay Phase 2; Deductible Deductible then 20%Ded then Covered In FullUrgent Care$35 Deductible then $70$100Deductible then $60Deductible then $60Phase 1; $60 Copay Phase 2; Deductible Deductible then 20%Ded then Covered In FullTelemedicine$15 Deductible then $30Covered in FullDeductible then $0Deductible then $25$0.00Deductible then 20%Ded then Covered In FullVisionAdult & PediatricAdult & PediatricAdult & PediatricAdult & PediatricAdult & PediatricAdult & PediatricAdult & PediatricAdult & PediatricCDPHP Network EPO (National) EPO (National) HMO EPO (National) HMO EPO (National) HMO EPO (National)HSA Qualified PlanNoNoNoYesYesNoYesYesPLATINUM #120GOLD #221GOLD #224GOLD #320SILVER #324SILVER #425 BRONZE #428BRONZE #421 Eligibility For Small Group eligibility, there must be at least one * Common Law Employee (CLE) enrolled. An employee does not include the sole owner or the spouse of the owner. If you do not qualify for a Small Group product, please contact our office for INDIVIDUAL plan options available to Members without a CLE. Open Enrollment During the month of November for January 1st coverage. All applications must be received in our office by Wednesday, December 1st, 2022 Pediatric Dental Required by the ACA for dependents under the age of 19. Monthly premium is $16.49 per child, $32.98 for 2 children and $49.47 for 3 or more children. (EPC) Enhanced Primary Care doctors can be found on the CDPHP portal. Embrace Paths Select 1 of 3 paths Fitness Medical Nutrition allowing members to use Bonus Points for any IRS qualified health expenses regardless of whether it is covered by your health plan. This is for the medical path. CDPHP Health Hub powered by Virgin Pulse’ Give employees programs, support, and guidance they need to take control of their health. Make personallized programs based on your health goals. Go Mobile-get the CafeWell app for mobile devices in your app store! Classes & Events available. Earn LifePoints for participating. Life Points Register with CafeWell to Participate in activities to earn Life Points. Domestic Partner Coverage included for Same or Opposite Sex Preferred Lab LabCorp Embedded Deductible For non-single contract tiers, each member will pay towards, but never exceed the individual deductible before the plan pays. Aggregate DeductibleFor non-single contract tiers, the family deductible must be met before the plan pays.Price Check Cost estimator allows HD plan subscribers to get cost estimates for many common health care services. HSA Contribution LimitsSingle $3,850 Family: $7,750 Catch-up Contributions (Age 55 or older) $1,000 Doctor on Demand - $0 No-cost video doctor visits from the comfort of home. (deductible applies on HSA Qualified high deductible plans)Drug Benefit: Generic/Brand Name/SpecialtySilver HDEPO Co-Pay First $10/$50/$80, not subject to deductibleBRONZE HDHMO (HSA Qualified)Provider Networks for all covered services can change at times throughout the plan year. It is strongly recommended that you search the provider network on each plan before submitting your enrollment and using the plan throughout the year to ensure that your provider of choice is participating in the plan you select. All plans include Emergency service 24/7, anywhere in the world. Point of Service (POS) networks include Out-of-Network providers, but at a higher cost share than In-Network. HMO networks do not include Out-of-Network providers. Exclusive Provider Organizations (EPO) typically includes comprehensive national provider networks.Deductible then Covered In Full, preventive drugs not subject to deductible2024 PLAN HIGHLIGHTS Monthly premium rates shown do not include administrative fees - Plan summaries available upon request.This comparison is a guide to assist you in evaluating the program and is not a complete comparison or contract and in no way details all the benefits, limitations or exclusions. Rates and terms subject to change.Bronze QHDEPO (HSA Qualified)SILVER #324$4 / $30 / $60Deductible then $10/$40/$60, Preventive drugs not subject to deductible$0/$50/$80BRONZE #421Platinum EPO Gold EPO EMBRACEGold HMO (Triple Zero) HDEPO Qualified Silver HMO (HSA Qualified)Deductible then $10/$50/$80, preventive drugs not subject to deductibleBRONZE #428Phase 1; $10/$30/$50 Phase 2; Deductible preventive drugs not subject to deductibleSILVER #425 Deductible then 20%/20%/20%, preventive drugs not subject to deductiblePLATINUM #120 GOLD #221 GOLD #224 SILVER #320Revised 11/2022 PO Box 1616 Troy NY 12181-1616 For assistance call 518-720-8888