Return to flip book view

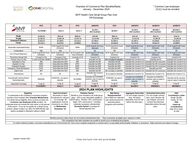

Chamber of Commerce Plan Benefits/RatesJanuary - December 2024 MVP Health Care Small Group Plan GridOff-Exchange* Common Law employee(CLE) must be enrolled PLATINUM 1 GOLD 3 GOLD 4 SILVER 3 (HSA Qualified) SILVER 7 SILVER 8 (HSA Qualified) BRONZE 5 (HSA Qualified) BRONZE 6 (HSA Qualified) Single$1,091.28$931.20$985.56$787.90$805.15$761.59$651.15$701.16Double $2,182.56 $1,862.40 $1,971.12 $1,575.80 $1,610.30 $1,523.18 $1,302.30 $1,402.32Employee/Child(ren)$1,855.18$1,583.04$1,675.45$1,339.43$1,368.76$1,294.70$1,106.96$1,191.97Family$3,110.15$2,653.92$2,808.85$2,245.52$2,294.68$2,170.53$1,855.78$1,998.31 Deductible (Individual/Family) $0/$0$1,000 Single/$2,000 Family (Embedded)$0/$0$2,550 Single/$5,100 Family (Aggregate)$3,100 Single/$6,200 Family (Embedded)$4,650 Single/$9,300 Family (Embedded)$6,500 Single/$13,000 Family (Embedded)$7,100 Single/$14,200 Family (Embedded)CoinsuranceN/AN/AN/AN/AN/A50%N/AOut of Pocket Maximum$2,450 Single/$4,900 Family (Embedded)$5,000 Single/$10,000 Family (Embedded)$6,750 Single/$13,500 Family (Embedded)$6,350 Single/$12,700 Family (Embedded)$8,700 Single/$17,400 Family (Embedded)$7,600 Single/$15,200 Family (Embedded)$7,250 Single/$14,500 Family (Embedded)$7,100 Single/$14,200 Family (Embedded)Preventive Annual Visit Covered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullCovered in FullPrimary Care Co-Pay 3 visits at $0 then $5/$45Deductible then $20$40 Deductible then $25$35, not subject to deductibleDeductible then Covered In FullDeductible then $5Deductible then Covered In FullSpecialist Co-Pay $45 Deductible then $40$60 Deductible then $50Deductible then $50Deductible then Covered In FullDeductible then 50% coinsuranceDeductible then Covered In FullInpatient Co-Pay $300 Deductible then $800$750 Deductible then $500Deductible then $750Deductible then Covered In FullDeductible then 50% CoinsuranceDeductible then Covered In FullOutpatient Surgery $100 Deductible then $100$300 Deductible then $200Deductible then $250Deductible then Covered In FullDeductible then 50% CoinsuranceDeductible then Covered In FullEmergency Room/Ambulance $100 Deductible then $300$500 Deductible then $300Deductible then $250Deductible then Covered In FullDeductible then $100Deductible then Covered In FullUrgent Care $45 Deductible then $40$60 Deductible then $50$50, not subject to deductibleDeductible then Covered In FullDeductible then 50% coinsuranceDeductible then Covered In FullTelemedicine $0 $0 $0 Deductible then Covered in Full$0, not subject to deductible Deductible then Covered In Full Deductible then Covered In Full Deductible then Covered In FullDrug Benefit: Generic/Brand Name/Speciality$5/$30/$50$10/$35/50%, not subject to deductible$10 /$40/$60Deductible then $15/$40/$60, preventive drugs not subject to deductible$15/$45/$90, not subject to deductibleDeductible then $15/$50/$65, preventive drugs not subject to deductibleDeductible then $5/$30/50%, preventive drugs not subject to deductibleDeductible then $0, preventive drugs not subject to deductibleDependent Coverage To Age 26To Age 26To Age 26To Age 26 To Age 26 To Age 26 To Age 26 To Age 26PLATINUM 1 GOLD 3 GOLD 4 SILVER 3 SILVER 7 SILVER 8 BRONZE 5 BRONZE 6Open Enrollment November is Open Enrollment for January 1st coverage. All applications must be received in our office by Wednesday, December 1stWell-Being Reimbursement Up to $600 per calendar year reimbursement for well-being items, programs and activitiesAggregate Deductible For non-single contract tiers, the family deductible must be met before the plan pays. Embedded Deductible For non-single contract tiers, each member will pay towards, but never exceed the individual deductible before the plan pays. HSA Contribution Limits Single: $3,850 Family: $7,750 HSA Catch-up Contributions (Age 55 or older) $1,000To confirm network providers, visit www.mvphealthcare.com, Find a Doctor link. This is not a complete comparison or contract and in no way details all the benefits, limitations, or exclusions. Rates and terms are subject to change.This comparison has been prepared as a guide to assist you in evaluating the program. Pediatric Dental Benefit is now included in all small group plans - $25 co-pay deductible applied to HDHP plans - Routine: 20% coinsurance * - Major: 50% coinsurance * including medically necessary orthodontists Domestic Partner Coverage for Same/Opposite Sex2024 PLAN HIGHLIGHTS Monthly premium rates shown do not include administrative fees - Plan summaries available upon request or onlineEligibility To participate in the Chamber's insurance program, business must maintain their Chamber Membership. For Small Group eligibility, there must be at least one * Common Law Employee (CLE) enrolled. An employee does not include the sole owner or the spouse of the owner. If you do not qualify for a Small Group product, please contact our office for INDIVIDUAL plan options available to Members without a CLE. EPO QHDEPOEPO EPO QHDEPO EPO QHDEPO QHDEPOUpdated: October 2022PO Box 1616 Troy NY 12181-1616 (p) 518-720-8888