Return to flip book view

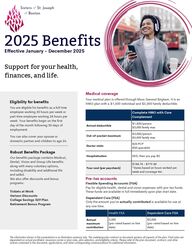

Complete HMO with CareComplementAnnual deductible$1,500/person$3,000 family maxOut-of-pocket maximum$3,000/person$6,000 family maxDoctor visits$25 PCP$50 specialistHospitalizationDED, then you pay $0Your cost (per paycheck)$144.74 - $719.84*Varies based on hours worked perweek and coverage tier. Health FSADependent Care FSAAnnualmaximumcontribution3,300 (pro-rated based on hiredate)$5,000 (pro-rated based on hiredate)Support for your health,finances, and life.2025 BenefitsFlexible Spending Accounts (FSA)Pay for eligible health, dental and vision expenses with pre-tax funds.These funds are available in full immediately upon plan start date. Pre-tax accountsThe information shown in this presentation is an illustrative summary only. The underlying plan contract or document governs all aspects of the plan. Final rates aredependent on actual enrollment, insurance carrier or plan rules, plan selection, and eligibility criteria. Please refer to the plan document, contract, and othernotices contained in this document, applications, and other corresponding communications for additional information.You are eligible for benefits as a full timeemployee working 30 hours per week orpart time employee working 24 hours perweek. Your benefits begin on the firstday of the month following 30 days ofemployment.You can also cover your spouse ordomestic partner and children to age 26.Eligibility for benefitsOur benefits package contains Medical,Dental, Vision and Group Life benefitsalong with many voluntary options,including disability and additional lifeand ad&d. We also offer discounts and bonusprograms:Tickets at WorkVerizon DiscountsCollege Savings 529 PlanRetirement Bonus Program Robust Benefits PackageMedical coverageYour medical plan is offered through Mass General Brigham. It is anHMO plan with a $1,500 individual and $3,000 family deductible.Effective January - December 2025Dependent Care (FSA)Only the amount you’ve actually contributed is available for use atany one time.

Wherever you are in your life, we'rehere to support you.The information shown in this presentation is an illustrative summary only. The underlying plan contract or document governs all aspects of the plan. Final ratesare dependent on actual enrollment, insurance carrier or plan rules, plan selection, and eligibility criteria. Please refer to the plan document, contract, andother notices contained in this document, applications, and other corresponding communications for additional information.Care for your smile and your eyes with regular check-ups. Needbraces or glasses? We have coverage for those too. Eyemed Vision: $10 Annual Exam every 12 months / $25 Materialscopay / $140 Frames Allowance every 24 monthsBCBS Dental:Dental & Vision coverageIf you're not able to work, how will the bills get paid? Make sureyou're protected with voluntary disability coverage. In most cases,you'll receive 60% of your paycheck for the first 26 weeks you'reunable to work, then 60% if you're still unable to return to work. Thiscoverage is available at an extra cost for employees.We also provide 1x salary life insurance benefit at no cost, and theoption to enroll in additional life and ad&d coverage for you, yourspouse and your children providing peace of mind and ensuring yourfamily is protected.Financial protectionA 403(b) plan is a long-term retirement investment program foremployees of non-profit organizations such as ours. It offersemployees a chance to invest pre-tax dollars while saving forretirement at at the same time. You have the option to invest withAmeriprise, Fidelity, or Vanguard. Retirement savingsOur no-cost, confidential EmployeeAssistance Program (EAP) provides up to 3face-to-face or virtual visits per issue eachyear with a licensed counselor. Just need some guidance? You can alsoaccess financial and legal resources, familyand community support, and so muchmore. Confidentially, and at no cost toyou.Mental health is health careYour BenefitsEffective January - December 2025Contact the Human Resources BenefitsOffice:Tammie Charles-PierreTammiecp@csjboston.orgTel:617-746-1627Questions?In NetworkBCBS MA Dental PPOAnnual Deductible$25 per person / $75 familyAnnual Maximum Benefit$1,500 per personPreventative Care100% CoveredBasic CareDeductible, then you pay 20%Major CareDeductible, then you pay 50%Colonial Life Benefit OfferingsYou also have access to numerous ColonialLife benefits if you wish to enroll in them:Term Life InsuranceVoluntary Short Term DisabilityCollege Tuition BenefitAccident InsuranceCritical Illness and Cancer Benefit