Return to flip book view

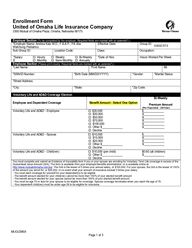

MUGC9859Page 1 of 3Enrollment FormUnited of Omaha Life Insurance Company3300 Mutual of Omaha Plaza, Omaha, Nebraska 68175Employer Section (To be completed by the employer. Required fields are marked with an asterisk(*).)*Employer Name: Andrea Katz M.D., F.A.A.P., PA dbaWatchung PediatricsEffective Date: Group ID:Sub Group ID: Location Code: Class: Occupation:*Salary:$o Hourlyo Monthlyo Weeklyo Semi-Monthlyo Bi-Weeklyo Annually*Date of Hire: Hours Worked Per Week:Employee Section (Please print clearly. Required fields are marked with an asterisk(*).)*Last Name: *First Name: MI:*SSN/ID Number: *Birth Date (MM/DD/YYYY): *Gender: *Marital Status:*Street Address:*City: *State: *Zip Code:Voluntary Life and AD&D Coverage ElectionEmployee and Dependent Coverage Benefit Amount - Select One OptionBi-WeeklyPremium Amount(Per Paycheck - 26/Year)Voluntary Life and AD&D - Employee o $20,000 $_____________o $30,000 $_____________o $50,000 $_____________o $70,000 $_____________o $100,000 $_____________o Other $_____________ $_____________o DeclineVoluntary Life and AD&D - Spouse o $10,000 $_____________o $15,000 $_____________o $25,000 $_____________o Other $_____________ $_____________o DeclineVoluntary Life and AD&D - Child(ren) o $10,000 (per child) $0.60 (all children)o Other $_____________ $_____________o DeclineYou must complete and submit an Evidence of Insurability form if you or your spouse are enrolling for Voluntary Term Life coverage in excess of theGuaranteed Issue Amount (GIA). The form is available from your employer/benefits administrator, or is available online athttp://www.mutualofomaha.com/eoi. The GIA is the lesser of 5 times your annual salary, or $100,000. For your spouse, the GIA is the lesser of 100%of the amount you enroll for, or $25,000. In no event shall your amount of insurance exceed 5 times your salary.- You must elect coverage for yourself for your dependent(s) to be eligible.- The benefit amount elected for your child(ren) cannot be more than 100% of your elected benefit amount.- The benefit amount elected for your spouse cannot be more than 100% of your elected benefit amount.- You must be age 70 or less for your spouse to be eligible for coverage. Spouse coverage terminates when you reach the age of 70.- Your dependent child(ren) must be under age 26 to be eligible for insurance.G000C5TX

MUGC9859Page 2 of 3Voluntary Dental Coverage ElectionEmployee and Dependent CoverageSelect One CoverageOptionBi-WeeklyPremium Amount(Per Paycheck - 26/Year)oDeclineThe following applies to Voluntary Dental coverage:- Your dependent child(ren) must be under age 26 to be eligible for insurance.Voluntary Vision Coverage ElectionEmployee and Dependent CoverageSelect One CoverageOptionBi-WeeklyPremium Amount(Per Paycheck - 26/Year)oDeclineThe following applies to Voluntary Vision coverage:- Your dependent child(ren) must be under age 26 to be eligible for insurance.Dependent Information (If you enrolled dependents for insurance, you must complete this section. Please print clearly.)If you need to list more dependents than space will allow, please include this information on a separate piece of paper and submit it with this form.Name of DependentLast name First NameGenderRelationshipto EmployeeBirth Date(MM/DD/YYYY)Beneficiary for Death Benefits (Right to change beneficiary is reserved to the insured.)If naming more than one beneficiary, please attach a separate signed and dated sheet. Beneficiaries shall share benefits equally unless otherwisestated. Some states have laws regarding beneficiary designation. Please consult your employer/benefits administrator for additional information.Primary Beneficiary DesignationLast Name First NameRelationshipto InsuredDate of Birth(MM/DD/YYYY)SSNTelephone:Address of Beneficiary(Address, City, State, Zip):Secondary Beneficiary DesignationLast Name First NameRelationshipto InsuredDate of Birth(MM/DD/YYYY)SSNTelephone:Address of Beneficiary(Address, City, State, Zip):Enrollment InformationEnrollment must occur within 31 days from the date the employee becomes eligible (or as otherwise stated in the applicable policy). If you arerequired to pay premiums for any coverage, the enrollment form MUST be signed and dated to authorize payroll deductions. The premium amountsindicated on this form are estimates, and are subject to change based on the final terms and conditions of the applicable policy as well as your ageand/or salary on the effective date of the coverage.Voluntary Dental - Employee Onlyo$14.48Voluntary Dental - Employee + Spouseo$29.73Voluntary Dental - Employee + Child(ren)o$40.40Voluntary Dental - Employee + Familyo$59.46Voluntary Vision - Employee Onlyo$2.79Voluntary Vision - Employee + Spouseo$5.30Voluntary Vision - Employee + Child(ren)o$6.19Voluntary Vision - Employee + Familyo$8.74

MUGC9859Page 3 of 3Agreement and SignatureI represent that the information I have provided in this enrollment form is complete, true and accurate to the best of my knowledge. I understand thatpayment of premium does not guarantee eligibility for coverage. I understand and agree that I must satisfy all active work or active eligibilityrequirements that pertain to the policy to be eligible for coverage. I understand and agree that insurance coverage for my eligible dependent(s) maybe delayed if they are confined (at home, in a hospital, or in any other institution or facility) or disabled on the date insurance would otherwise begin,in accordance with the terms of the policy.Should I apply for waived coverage in the future, I understand that evidence of insurability may be required, acceptable to the underwriting company,at my own expense. I understand that if coverage is applied for in the future, it must be during an enrollment period approved by the underwritingcompany or due to a life change event as defined or allowed by the applicable policy, and that a waiting period may apply.By signing below, I acknowledge that I understand and agree to the above statements, and that I have read and understand the benefit summary oroutline of coverage provided to me for each type of coverage. The above requirements will apply unless otherwise stated in the applicable policy, orunless prohibited by any applicable state or federal law.SIGNATURE OF EMPLOYEE _________________________________________ DATE ________/________/________Additional InformationFraud Warning: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance orstatement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact materialthereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties. (Note: This fraud warning doesnot apply to residents of AL, AR, CA, CO, DC, FL, KS, KY, LA, ME, MD, NJ, NM, NY, OH, OR, PR, RI, TN, VT and VA. Please review the specificfraud warning for your state of residence if provided below, or view it online at www.mutualofomaha.com.)New Jersey Fraud Warning: Any person who includes any false or misleading information on an application for insurance is subject to criminal andcivil penalties.

463210Guide to Submitting Member Enrollment Requests Employer AccessManaging employee benefits can be time consuming. But Mutual of Omaha offers quick, convenient options that simplify plan administration. Not registered to use our portal? If you are not a registered user of Employer Access, go to mutualofomaha.com. 1) Click on Sign In 2) Select Plan Administrator 3) Click the Sign Up Button (bottom of the screen)See the next page for more convenient enrollment options!Content is subject to change. Insurance products and services are offered by Mutual of Omaha Insurance Company or one of its affiliates. Products are not available in all states. Each company is solely responsible for its own contractual and financial obligations. Secure Online Plan Administration Spend less time on paperwork and expedite transactions with our secure online portal. Through Employer Access, you can quickly and easily enroll, update or terminate employee coverage from a single screen. Once you log in to the secure portal: • Click on the “Members” tab and search for the member’s name• Access functions such as updating eligible employee roster, sending Evidence of Insurability (EOI), and editing or terminating employees• Click the green “New Enrollment” button to add new employeesEmployees who were terminated and rehired need to be added to the roster via a request to our service team.Questions or Need Assistance? Contact your Dedicated Service Team.

463210Options When Using Paper Enrollment Enrollment Form If you prefer using the paper enrollment process, each employee must complete and sign an enrollment form. Enrollment forms must be filled out completely to avoid delays in processing; required fields are marked with an asterisk (*). Return completed forms to your Dedicated Service Team.Note: A new hire enrollment form was included in your welcome email. Excel Spreadsheet If you prefer to capture new employee information in a spreadsheet format, Mutual of Omaha will accept an Excel file. To expedite your request, please include the information listed here.Type of Change Requested (Hires, Qualifying Life Event, etc.)Effective Date of Change • Member’s First and Last Name• Date of Birth (Employee and Spouse)• Date of Hire or Rehire• Signature Date (Contributory/Voluntary)• SSN (optional but strongly preferred for Dental/Vison)• Salary: Annual or Hourly• Hours Worked per Week• Coverage Elections by Product• Tobacco Status, if Applicable• Class (if more than one class)• Bill Group (if receiving separate bills)• Location Code (if receiving one bill and employees are itemized by location/department)• Termination Date (last date worked)Dental & Vision Benefits Require: • Address• Dependents: First and Last Name, Date of Birth & GenderWe must receive all required information before completing the enrollment process. Important