Return to flip book view

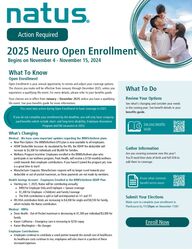

Enroll NowYou must take action during Open Enrollment to have coverage in 2025. If you do not complete your enrollment by the deadline, you will only have company-paid benefits which include short- and long-term disability, Employee AssistanceProgram and life insurance in 2025.Gather InformationAre you covering someone new this year?You'll need their date of birth and full SSN toadd them to coverage. Open Enrollment is your annual opportunity to review and adjust your coverage options.The choices you make will be effective from January through December 2025, unless youexperience a qualifying life event. For more details, please refer to your benefits guide.Your choices are in effect from January – December 2025 unless you have a qualifyinglife event. See your benefits guide for more information.Open EnrollmentReview Your OptionsSee what's changing and consider your needsin the coming year. See benefit details in yourbenefits guide.What To Know2025 Neuro Open Enrollment Begins on November 4 - November 15, 2024What To DoAction RequiredMedical - We have some important updates regarding the BRMS/Anthem plansSubmit Your ElectionsMake sure to complete your enrollment inPlanSource by 11:59pm on November 15th! See your benefitsguideWhat's ChangingNew Plan Option: The BRMS/Anthem EPO plan is now available to all employees.HDHP Deductible Increase: As mandated by the IRS, the HDHP the deductible willincrease to $3,300 for individuals and $6,600 for families.Wellness Program Incentive: Employees enrolled in the BRMS/Anthem plan whoparticipate in our wellness program, Peak Health, will receive a $150 monthly wellnesscredit towards their employee contributions. If you haven’t joined the program yet, nowis a great time to start!Manufacturer Coupons: Manufacturer coupons will no longer count towards yourdeductible or out-of-pocket maximum, as these payments are not made by members.Health Savings Account - Employees Enrolled in the BRMS/Anthem HDHP PlanDean Health - Out-of-Pocket maximum is decreasing to $1,500 per individual/$3,000 forfamilyKaiser California – Emergency care is increasing to $250 copayKaiser Washington – No changesMedical - HMOsStarting Jan. 1, 2025, Natus will be contributing annually:$900 for Employee Only and Employee + Spouse coverage$1,200 for Employee +Child(ren) and Family CoverageThe HSA contribution is split in half and deposited on 1/1 and 7/1IRS HSA contribution limits are increasing to $4,300 for single and $8,550 for family,which includes the Natus contribution.Employee ContributionsEmployees continue to contribute a small portion towards the overall cost of healthcare.As healthcare costs continue to rise, employees will also share in a portion of theseincreased expenses.Know what commonbenefit terms mean